The recent tech selloff has sent shockwaves through the US stock market, prompting investors to reassess their portfolios and strategize for the future. In this article, we delve into the factors contributing to this selloff and its impact on US stocks, offering insights and analysis for those navigating the tumultuous waters of the stock market.

The Tech Selloff: A Quick Overview

The tech selloff refers to the sharp decline in the value of technology stocks over a short period. This decline has been attributed to various factors, including concerns over inflation, rising interest rates, and global economic uncertainties. The tech sector, which has been a major driver of the stock market's growth over the past decade, has been particularly hard hit.

Factors Contributing to the Selloff

1. Inflation Concerns:

Inflation has been a hot topic in recent months, and it has had a significant impact on the stock market. As the cost of living rises, companies may face increased expenses, which could lead to lower profits. This has prompted investors to sell off tech stocks, which are often seen as more vulnerable to inflationary pressures.

2. Rising Interest Rates:

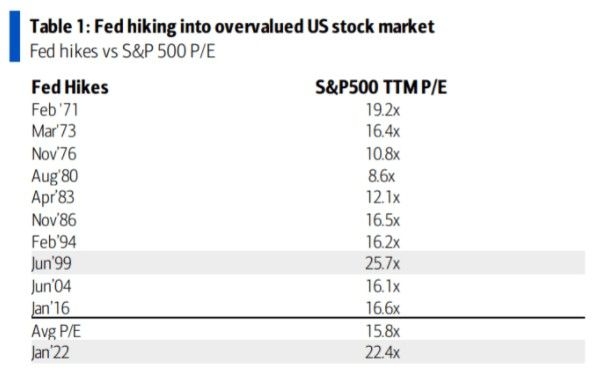

The Federal Reserve has been raising interest rates to combat inflation, and this has had a negative impact on tech stocks. Higher interest rates make borrowing more expensive, which can lead to reduced spending and investment by companies in the tech sector.

3. Global Economic Uncertainties:

The ongoing global economic uncertainties, such as the conflict in Ukraine and the pandemic's lingering impact, have also contributed to the tech selloff. These uncertainties have created a risk-averse environment, with investors seeking safer investments.

Impact on US Stocks

The tech selloff has had a significant impact on the US stock market, with several key indices experiencing declines. The S&P 500 and the Dow Jones Industrial Average have both seen notable drops, with tech stocks playing a major role in these declines.

Case Studies:

What Investors Should Do

Given the current market conditions, investors should be cautious and consider the following strategies:

The tech selloff has been a wake-up call for investors, highlighting the risks associated with the tech sector. By understanding the factors contributing to the selloff and taking appropriate measures, investors can navigate the turbulent waters of the stock market and achieve their investment goals.

ford motor company stock