The stock market is often considered the pulse of the economy. When stocks drop, it can have a ripple effect on the entire financial landscape. This article delves into the impact of stock drops on the US economy, exploring the potential consequences and the measures taken to mitigate them.

Understanding Stock Drops

A stock drop refers to a decline in the value of a company's shares on the stock market. This can occur due to various factors, including poor financial performance, economic downturns, or market speculation. When stocks drop, it can lead to a loss of investor confidence, affecting the broader economy.

Economic Consequences of Stock Drops

Consumer Confidence: Stock drops can erode consumer confidence, leading to reduced spending. As investors see their portfolios shrink, they may become more cautious with their finances, which can impact consumer spending on goods and services.

Business Investment: Stock drops can also discourage businesses from investing in new projects or expanding their operations. With lower stock prices, companies may find it more difficult to raise capital, leading to a slowdown in economic growth.

Job Losses: Stock drops can have a direct impact on employment. Companies may cut costs by reducing their workforce, leading to higher unemployment rates.

Retirement Savings: Stock drops can significantly impact retirement savings. As retirement accounts are often heavily invested in the stock market, a decline in stock prices can lead to a reduction in retirement savings, potentially affecting the standard of living for many Americans.

Measures to Mitigate the Impact

Governments and financial institutions have implemented various measures to mitigate the impact of stock drops on the economy. Some of these include:

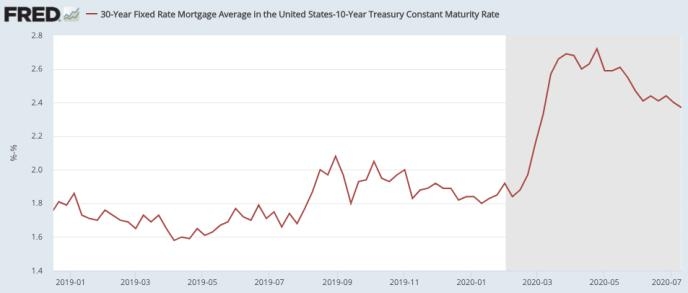

Interest Rate Cuts: Central banks, such as the Federal Reserve, may lower interest rates to stimulate economic growth and encourage borrowing and investment.

Quantitative Easing: Central banks may engage in quantitative easing, which involves purchasing government securities to increase the money supply and lower interest rates.

Fiscal Stimulus: Governments may implement fiscal stimulus packages, which include tax cuts and increased government spending, to boost economic activity.

Case Studies

The 2008 financial crisis serves as a prime example of the impact of stock drops on the economy. The collapse of major financial institutions, such as Lehman Brothers, led to a significant drop in stock prices. This, in turn, triggered a global economic downturn, resulting in high unemployment rates and reduced consumer spending.

Another example is the recent COVID-19 pandemic. The sudden halt in economic activity led to a sharp decline in stock prices. However, through a combination of monetary and fiscal policies, the US economy was able to recover relatively quickly.

Conclusion

Stock drops can have a significant impact on the US economy. While they are a natural part of the market cycle, it is crucial for governments and financial institutions to implement measures to mitigate their impact. By understanding the potential consequences and taking proactive steps, we can ensure a more stable and resilient economy.

ford motor company stock