Investing in foreign stocks can be a daunting task, especially for beginners. However, LG Chem, a renowned South Korean company, has gained significant traction in the global market, including the United States. This article delves into the feasibility of buying LG Chem stock in the US, covering everything from the process to potential risks and returns.

Understanding LG Chem

LG Chem, short for LG Chem, Ltd., is a multinational chemical company based in Seoul, South Korea. The company was founded in 1947 and has grown into a major player in the global chemical industry. LG Chem is renowned for its innovative products and services, which span various sectors, including petrochemicals, chemicals, and batteries.

Buying LG Chem Stock in the US

Buying LG Chem stock in the US is entirely feasible, but it requires a few steps. Here's a breakdown of the process:

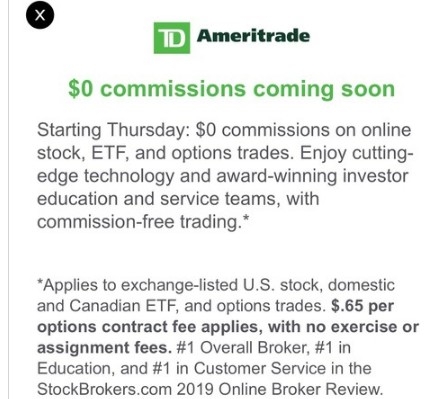

Open a Brokerage Account: The first step is to open a brokerage account with a US-based broker. This will enable you to trade stocks online. Several well-known brokers, such as TD Ameritrade, E*TRADE, and Fidelity, offer platforms for international stock trading.

Research and Analyze: Before investing in LG Chem, it's crucial to research and analyze the company's financial health, market position, and growth potential. Look for factors like revenue growth, profitability, and debt levels.

Place an Order: Once you've completed your research, you can place an order to buy LG Chem stock through your brokerage platform. You can choose between a market order or a limit order, depending on your strategy.

Potential Risks and Returns

Like any investment, buying LG Chem stock comes with its own set of risks and potential returns.

Risks:

Exchange Rate Fluctuations: Investing in foreign stocks exposes you to exchange rate fluctuations, which can impact the value of your investment.

Political and Economic Risks: South Korea's political and economic stability can impact LG Chem's performance, potentially affecting your investment.

Returns:

Long-term Growth: LG Chem has shown strong long-term growth potential, especially in the battery sector. This could lead to substantial returns on investment.

Dividends: LG Chem may offer dividends, providing an additional source of income.

Case Studies

Let's take a look at a couple of case studies to provide some context.

Case Study 1: In 2020, LG Chem's battery business, LG Energy Solution, secured a significant order from Ford Motor Company to supply batteries for electric vehicles. This deal not only validated LG Chem's battery technology but also highlighted its growth potential.

Case Study 2: LG Chem's investment in the battery sector has paid off, as the company's revenue from batteries has seen substantial growth in recent years.

Conclusion

Buying LG Chem stock in the US is a viable option for investors looking to diversify their portfolio and capitalize on the company's growth potential. However, it's crucial to conduct thorough research and understand the associated risks.

ford motor company stock